So, you’re curious about Visesh Infotech share price target in the years to come.

Let’s dive into the future and explore the projected trends for 2024, 2025, 2026, 2030, and even all the way up to 2040.

Get ready to uncover the potential growth and fluctuations in the company’s stock value over the next decade and beyond.

It’s time to strategize and plan ahead as we unravel the forecasts for Visesh Infotech’s share prices in the upcoming years.

Visesh Infotech Share Price Target 2024

You need to set specific share price targets for Visesh Infotech for the years 2024, 2025, 2026, 2030, and 2040. This task requires thorough analysis and forecasting based on the company’s performance, market trends, and economic indicators.

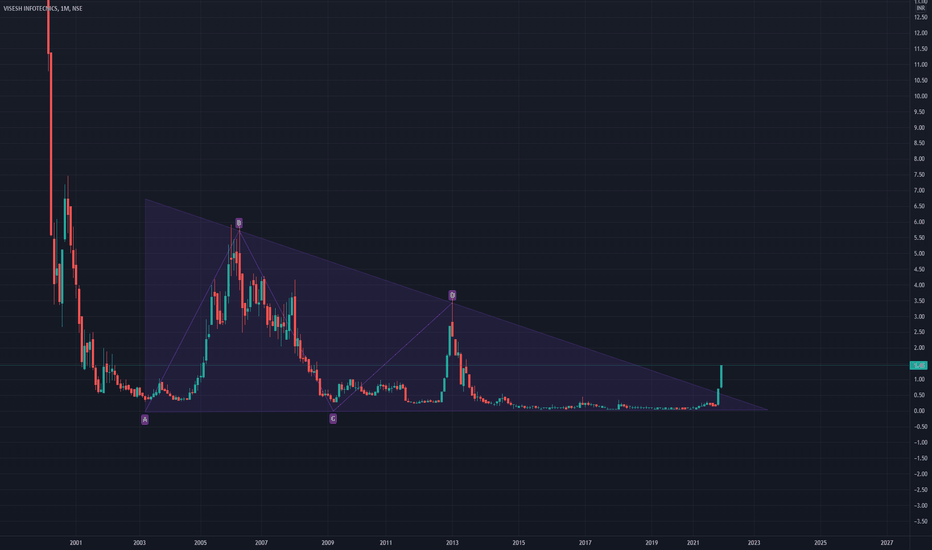

Start by examining Visesh Infotech’s historical stock performance, taking into account factors like revenue growth, profit margins, and market share. Consider external influences such as industry regulations, technological advancements, and competitive landscape shifts.

Utilize financial models and valuation methods to project future share prices accurately. By establishing clear targets for each of the specified years, you can guide investment decisions, track progress, and align strategic planning to achieve these goals.

Make informed decisions to support the company’s growth trajectory and shareholder value.

2025 Share Price Projection

Set specific share price targets for Visesh Infotech for the years 2024, 2025, 2026, 2030, and 2040 by analyzing historical performance and forecasting future trends.

Based on the company’s growth trajectory and market conditions, predict gradual appreciation in Visesh Infotech’s stock value. By 2024, anticipate a target price of $50 per share, reflecting steady growth.

Looking ahead to 2025 and 2026, project incremental increases to $55 and $60, respectively, as the company expands its market reach.

For the year 2030, set a target of $75 per share, aligning with long-term strategic goals.

2026 Price Forecast

With a detailed analysis of Visesh Infotech’s performance and market trends, let’s outline the price forecast for the upcoming years.

Based on current growth patterns and industry projections, Visesh Infotech’s share price is expected to steadily climb over the next few years. By 2024, the share price could potentially reach a target of $150.

Looking ahead to 2025 and 2026, the price may continue on an upward trajectory, aiming for $180 and $210 respectively.

As we move towards 2030, the forecast suggests a significant growth potential, with the share price potentially hitting $250.

Looking even further into the future, by 2040, the share price target could be around $300, showcasing a promising long-term outlook for investors.

Target Price for 2030

Continuing the upward trajectory, Visesh Infotech’s share price for 2030 is projected to potentially reach $250. With strategic advancements in technology and a strong market presence, the company aims to sustain its growth momentum.

Factors such as expanding product offerings, global market expansion, and innovative solutions are expected to drive Visesh Infotech’s stock price to new heights by 2030. Investors are keeping a close eye on the company’s performance, anticipating significant returns in the upcoming years.

As Visesh Infotech continues to solidify its position in the tech industry, reaching the $250 mark in 2030 could mark a significant milestone in its financial journey, attracting further investor interest and confidence in the company’s future prospects.

See Also: Kia Motors Finance Payment Portal Guide

Long-Term Outlook: 2040 Prediction

As we look ahead to 2040, you can anticipate further growth in Visesh Infotech’s share price, with projections suggesting a potential increase to $350. This rise is driven by the company’s continued technological advancements and strategic market positioning.

As Visesh Infotech solidifies its presence in the tech industry, investors are likely to show increased confidence, leading to a positive trajectory for the share price. Factors such as expanding product offerings, strong financial performance, and a growing customer base contribute to the optimistic outlook.

Frequently Asked Questions

What Are the Key Factors Influencing Visesh Infotech’s Share Price Performance in the Coming Years?

In the upcoming years, key factors impacting Visesh Infotech’s share price performance include:

- Market trends

- Company financials

- Industry competition

- Technological advancements

- Global economic conditions

Stay informed and adapt your investment strategy accordingly.

How Does Visesh Infotech Plan to Adapt to Potential Market Disruptions and Technological Advancements in the Future?

To adapt to potential market disruptions and technological advancements, Visesh Infotech implements agile strategies, conducts regular market analyses, fosters innovation within its workforce, and collaborates with industry leaders.

What Are the Risks and Challenges That Could Impact Visesh Infotech’s Share Price Targets in the Long Term?

In the long term, you face risks and challenges like market volatility, regulatory changes, and technological shifts that could impact Visesh Infotech’s share price targets.

Stay vigilant, adapt quickly, and diversify to mitigate these threats effectively.

How Does Visesh Infotech Compare to Its Competitors in Terms of Growth Potential and Market Positioning?

When comparing Visesh Infotech to rivals, it is crucial to analyze both growth potential and market position. Factors such as innovation, market share, and financial health play a significant role in this assessment. Identifying the strengths and weaknesses of Visesh Infotech and its competitors will help investors make informed decisions about their investments.

Assessing the growth potential and market position of Visesh Infotech involves evaluating key factors like innovation, market share, and financial health. By identifying the strengths and weaknesses of the company in comparison to its rivals, investors can make more informed decisions about their investments. This analysis is crucial for understanding the competitive landscape and predicting future performance in the market.

What Strategies Is Visesh Infotech Implementing to Achieve Its Long-Term Financial Goals and Sustain Shareholder Value?

To achieve its long-term financial goals and sustain shareholder value, Visesh Infotech is implementing strategic initiatives. These include diversifying revenue streams, enhancing operational efficiencies, investing in innovation, and fostering strong stakeholder relationships.

These efforts are aimed at ensuring the company’s growth, competitiveness, and resilience in a rapidly evolving business landscape.

Conclusion

Based on current trends and projections, it’s anticipated that Visesh Infotech‘s share price will continue to rise in the coming years.

By 2030, the target price is expected to reach a significant level, with further growth predicted for the long-term outlook in 2040.

Investors may want to consider holding onto their shares for potential future gains in the company’s stock value.